What is a credit builder card?

A credit builder card is a credit card designed to help people build, or rebuild, their credit score. They tend to come with higher interest rates and lower credit limits, but, if used responsibly, they can build your credit score over time.

If you have never borrowed before, or had issues managing credit in the past, a credit builder card could be a helpful tool to improve your credit score. Keep in mind, missing payments can harm your score.

Why apply for the Ocean Credit Card?

- See if you’re eligible - without affecting your credit score

- Get a response in just 60 seconds

- Get a credit limit up to £1,500

- Credit limit increases available if eligible (remember, a bigger balance could take longer to pay back and increase the amount of interest you’re paying)

How does a credit builder card work?

Building your credit score with a credit builder card is simpler than it sounds. By following these two easy tips, you can show lenders you’re a responsible borrower:

1. Keep your spending low

Aim to spend no more than a quarter of your credit limit. Since credit builder cards usually start with a lower limit, this means making smaller purchases at first.

Try using it for regular purchases like petrol or food shopping. Over time, with responsible use, you may be able to ask your lender to raise your limit.

2. Pay on time, every time

Try to pay off your card in full each month to avoid paying interest on any leftover balance. Setting up a Direct Debit from your bank account can help you stay on top of payments.

After following these steps, you could see your score improve within months. This means when you borrow money in future, like for a mortgage or car finance, you may be able to get a better rate.

How to get an Ocean Credit Builder Card

To apply for a credit card, follow our easy step-by-step process:

- Check your eligibility - Complete our simple form.

- Apply online - Get a yes or no in 60 seconds.

- If accepted - You’ll receive your card within 10 days.

39.9% APR Representative (variable)

Who are credit builder cards for?

You may be eligible for a credit builder card if you have:

How to build your credit score

Using your credit builder card responsibly is a great start, but there are other simple steps that can help boost your score:

Add your name to household bills - this links your repayments to your credit file, showing lenders you can keep up with payments.

Pay all bills on time, each month - this shows lenders that you’re a reliable borrower.

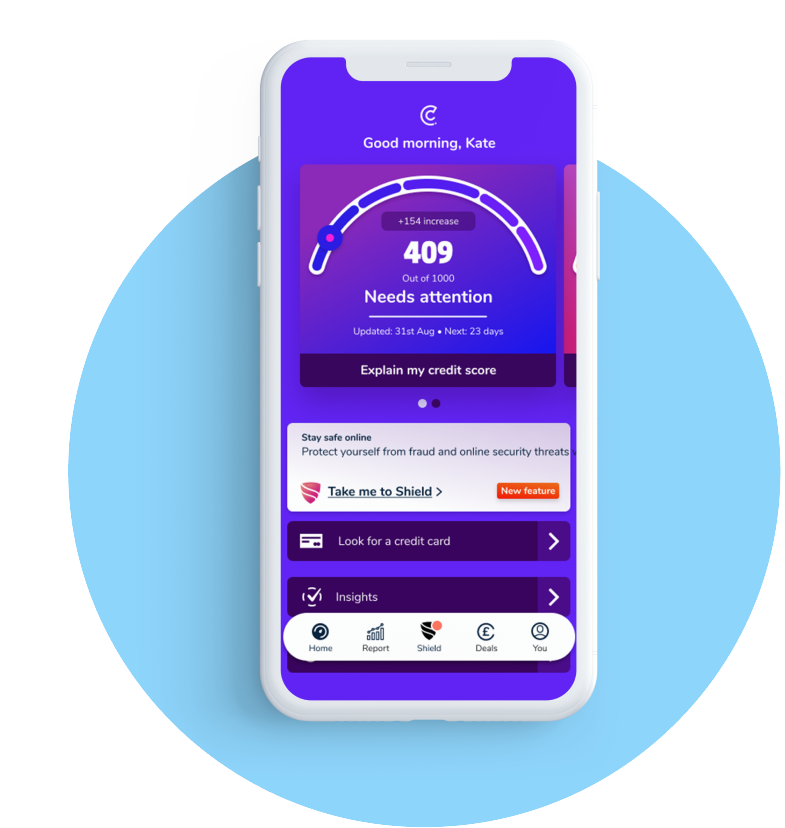

Check for mistakes - check your credit report regularly with all three credit reference agencies to help you spot and correct errors quickly.

Remove old financial ties from your credit report - A financial tie links your credit file to someone else's because you share a joint account, loan, or mortgage. Lenders might check both your finances when one of you applies for credit, and the link stays until the shared account is closed or paid off.

Space out credit applications - use an eligibility checker first to see how likely you are to be accepted.

After following these steps, check in with the three main credit reference agencies to see your progress. With CredAbility, you can even view your Equifax report for free, for life.

For more ways to build credit, visit our guide on 45 ways to improve your credit score.

How could we help you?

Ocean has provided access to loans, credit cards and mortgages to people across the UK since 1991. In this time, we’ve pre-approved more than a million people, offering products and advice to suit their circumstances.

- All credit histories considered

- Check your eligibility without affecting your credit score

- Save time finding the right loan deal

You can learn more about Ocean on our about us page.

Last updated

Fact-checked

This page has been reviewed to ensure it is accurate and compliant with FCA guidelines.

For more information on our fact-checking process, read our editorial policy.