From trying to work out how interest rates are calculated, to wondering what happens to your debts if you pass away, we have a lot of questions about our finances.

So, we’ve rounded up the top 10 questions about credit, borrowing and debt, according to Google data, and answered them all here, in one place.

1. How do you calculate APR on a loan?

An Annual Percentage Rate, or APR, represents the cost of borrowing money over a year. It takes into account both the interest rate that you’ll be charged for the credit you’re taking and any fees like admin fees or annual account fees that you must pay to have that type of credit. Sometimes, you’ll see that the interest rate and the APR for a finance product are different, and this is usually because there are fees charged as well as interest.

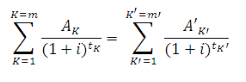

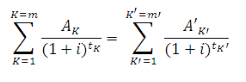

If you wanted to calculate the APR on a loan or another type of credit, then this is the equation you'd need to use:

Fortunately, lenders are required to calculate this for you, and will usually share a representative APR alongside information about the credit they offer. When you see a representative APR, this means that at least 51% of customers receive the rate shown or better. Lenders will also often show a representative example that explains how the cost of borrowing breaks down between interest and compulsory fees. If you choose to apply and you’re approved, the lender will confirm both the interest rate, fees and the APR that you will be charged.

The best APRs can be as low as 0%, where no interest or fees are charged, or as high as 1,000% or more, where interest and fees are very high. What makes a good APR depends on the type of credit you’re looking at, as different types of borrowing come with different criteria that make them more or less expensive than others. As a rule of thumb, the lower the APR, the less that credit will cost you.

Comparing APRs can help you see what your cheapest borrowing options are, but it’s useful to look at the cost of borrowing in pounds and pence, too.

2. How is the interest on a loan calculated?

Whenever you borrow money, you will pay interest to the lender as part of your monthly repayments. Interest rates are usually calculated and expressed as a percentage of the total you’re borrowing, and you can find out how this translates into the amount of money you’ll pay by using a loan calculator.

Loan calculators allow you to enter the details of your loan – the amount, term and interest rate – and they’ll do the maths for you to reveal:

- how much you’ll pay each month

- what you’ll repay in total over the life of the loan

- and how much of that is interest.

The interest rate a lender charges is partly down to what type of credit they offer, how much you want to borrow and how long for. But it’s mostly determined by how likely they think you are to pay them back, and if they think there’s a chance you won’t, how happy they are taking that risk.

Generally, the more risk a lender thinks there is that you won’t repay them, the higher your interest rate will be. Different lenders have their own policies on how happy they are with different amounts of risk, which is why interest rates can vary so much from lender to lender. This also means that even if you’ve been seen as a “risky” borrower by one lender, another may not feel the same way.

3. Can I get a loan with bad credit?

Bad credit can happen when your credit history includes things like missed payments, defaults, County Court Judgements (CCJs) and debt solutions like IVAs (Individual Voluntary Arrangements). Lenders will see your credit history on your credit report, when you apply for finance.

Having a history of not keeping up with debt repayments can make lenders doubtful that they’d get their money back if you borrowed from them. So, you’ll probably find it more difficult to get a loan with bad credit.

However, having bad credit doesn’t mean your chances of getting a loan or credit card are zero. There are some lenders who specialise in helping people in this situation to borrow what they need and start to show that they can and will repay what’s lent to them.

If you have bad credit, you may only be able to borrow a small amount to start with, and the interest rate will likely be relatively high. But, over time, as you build up a good payment history, your credit score should rise, and you should find it easier to get approved with more different lenders, offering higher loan amounts or credit limits at lower interest rates.

4. Can I get a mortgage with bad credit?

Getting a mortgage normally means borrowing a large amount of money – sometimes hundreds of thousands of pounds – to be repaid over a period of up to 30 years (or longer). This is a big commitment both for the lender and the borrower, and so lenders tend to require that you have a good credit history to be able to borrow from them.

That doesn’t mean it’s impossible to get a mortgage with bad credit, but, as with getting any type of loan with bad credit, it may be more difficult. You likely won’t have as much choice of different lenders and deals to pick from. On top of that, lenders may ask you for a bigger deposit, and you may not qualify for their lowest rates or longest fixed-rate deals.

If you’re thinking about applying for a mortgage but your credit score leaves a bit to be desired, it’s a good idea to work on improving it before you apply, so you stand a better chance of being approved for the best mortgage deals available.

5. How can I improve my credit score?

Improving your credit score is usually a case of:

- registering to vote, if you’re eligible to vote in the UK and haven’t already registered

- building your credit history if you don’t have one yet

- making all your credit and bill payments on time

- ensuring there are no mistakes or errors in your credit report

- spreading out your applications for credit – 3 in 12 months is a good rule of thumb to stick to

- keeping your credit utilisation moderate, so you don’t get too close to your account limits

For more tips on building and improving your credit score, check out 45 of them in our ultimate guide!

6. Does an overdraft affect your credit score?

Yes. When you use an overdraft, you’re using credit that’s given to you by your bank. The bank will then share information about your overdraft use – but not usually about your transactions – with credit reference agencies. This means it’ll be included in your credit report and can affect your credit score.

The impact using an overdraft has on your credit score will be greater if you use your overdraft frequently or are using an unarranged overdraft (one that you don’t have a pre-agreed limit for with your bank). Habits like frequent overdraft use can be a red flag to lenders as it’s a sign you’re running out of money before you’ve paid for everything you need to in a month. This can make lenders wonder if you’d have difficulty paying back what you borrowed from them.

7. Can I get a loan if I’m unemployed?

Being unemployed doesn’t make it impossible to get a loan, but you will likely have a limited choice of lenders, may not be able to borrow large sums of money, and will probably be charged higher rates of interest.

Generally, before a lender approves your application, they will want to be confident that you have the income to repay what you borrow. Some lenders specifically require that you have a job and may request proof of this. Others may accept you if you get your income from benefits, a pension or another source. But they will still need to be sure that the money you have will cover your payments and leave you with enough to pay for your essentials like housing costs, bills and groceries.

Borrowing money when you’re unemployed can be a useful way to bridge the financial gap while you’re not earning. However, it’s something to think through very carefully, and you should make sure that you’re confident you’ll always be able to keep up with your repayments. This is especially important if you’re unemployed. Even if you’re confident you’ll be back in work soon, it’s useful to plan for the worst-case scenario too, and be sure you’ll still be able to manage your payments if it takes you longer than expected to find a new job.

8. What is a secured loan?

A secured loan is a type of borrowing that’s secured against your property. This means you must own your home to be able to get one. Because they’re only available to homeowners, you sometimes see them called homeowner loans, too.

Because your property is used as security, the amount you can borrow with a secured loan tends to be more than if you got a personal (or unsecured) loan. Secured loans tend to start from about £10,000 and go up to £500,000 or more. The interest rates on secured loans can often be lower than personal loans, too.

Bear in mind that your property would be put at risk if you were to fall behind on the repayments (in the worst case scenario). So, you will want to think carefully before you take out a secured loan. Make sure that you can afford the repayments both now and in the future.

Lots of people who get a secured loan use them for things that will add value to their property, like doing an extension or big renovations. Or, many people also use them to consolidate other debts and significantly reduce their monthly outgoings. However, doing this can mean that you’re taking longer to repay what you owe, and may pay more in interest in total.

9. How do I get out of debt?

There are lots of different methods and things you can do to get out of debt. The best option for you depends how much money you owe and what sort of financial situation you’re in. For example, if you’ve fallen behind on payments because you don’t have enough money coming in, then the best method for you may be different compared to someone who can pay off their debts by cutting back on their everyday spending.

Options you may want to think about include consolidation loans, debt repayment strategies like the snowball method or the avalanche method, or, if you’ve fallen behind on your payments, debt repayment plans or an IVA. Bear in mind though, that paying less than the contractual amount each month can affect your credit score.

If you’re not sure what the best way forward is for you, then it could help to have a chat with an expert and see what their advice is. You can get independent, expert advice from charities like StepChange for free. They can help you to figure out what your best next step is.

10. What happens to your debts when you die?

Thinking about what will happen when we’re no longer here is uncomfortable for many people. But, it’s also helpful to some to know what will need to be done with their money once they’re gone, so they can leave their affairs in order as best they can. Knowing what happens to money you owe, if you aren’t able to repay it all before you die, is a big part of this.

When you die, any money you owe, for example credit card bills, outstanding loans or the mortgage on your home, will be paid from your estate. This is the money and property you leave behind. Your debts will be taken care of by the executor or administrator of your estate, often with the help of a solicitor.

Your debts will not automatically become the responsibility of your partner, spouse or next of kin when you die, and they will not be expected to repay them out of their own pocket. The exception to this is joint accounts that you have, such as a joint mortgage or where someone has acted as a guarantor for you. In this situation, the bill does usually pass to them to repay.

If your debts are to be repaid by your estate and there isn’t enough money there to cover everything you owed, then a strict process will be followed by your executor or administrator. They will repay each lender or organisation in a set order depending on the type of debt it is, until the money runs out. For example, mortgages or secured loans that have an outstanding balance will usually need to be settled before any personal loans or credit cards you had. If your home forms part of your estate and is jointly owned by a partner who has survived you, they may have to sell the property to pay your debts.

Any debts and bills you leave behind must be paid before any money from your estate is given to people as inheritance. So, the more you can settle ahead of time, the simpler your affairs will be for your executor or administrator to handle when they need to.

Looking for more questions, answered? Check out our Guides hub to see if we’ve answered the question that’s on your mind!

Methodology

We analysed Google UK search queries to identify the top 10 credit questions between March 2021 and February 2022:

|

Topic

|

Number of search queries

|

|

APR - how to calculate

|

97,200

|

|

How to improve credit score

|

96,000

|

|

How is loan interest calculated

|

43,200

|

|

Bad credit how to get a loan

|

28,800

|

|

Loans for unemployed

|

22,800

|

|

How to get out of debt

|

19,200

|

|

Does an overdraft affect your credit score

|

15,600

|

|

Can you get a mortgage with bad credit

|

15,600

|

|

What is a secured loan

|

12,000

|

|

What happens to debt when you die

|

10,560

|