The credit reference agencies have always been super secretive about their credit scoring systems…

For years, little was known about how the credit reference agencies calculated your credit score and it was nothing more than a mysterious number that decided your financial fate.

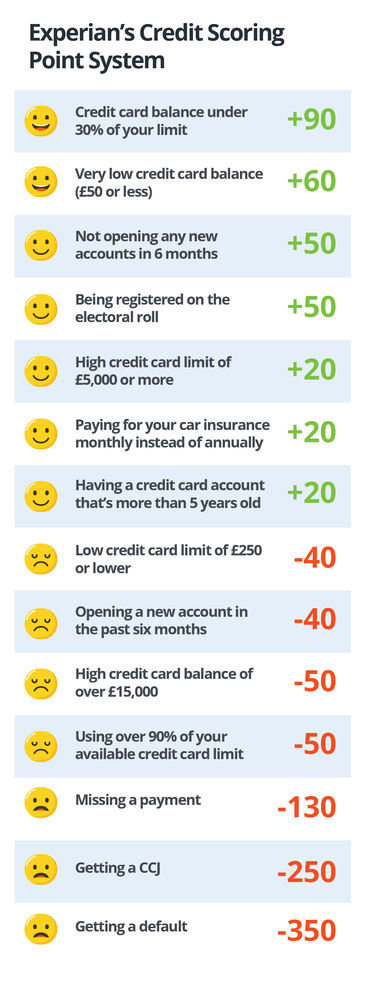

Until recently, they have all kept their cards close to their chests… but Experian has spilt the beans on their scoring model. In the table below, you can see for yourself what financial behaviours may make your credit score rise, as well as fall.

Remember, there is no such thing as a universal credit score and each credit reference agency has its own method for calculating your score. These guideline figures apply to your Experian credit score only.

The top example, in which you get +90 points, is called your credit card utilisation rate. You may get rewarded with Experian if you don’t use more than 30% of your credit limit. So, if you have a limit of £1000, it’s recommended to not be spending more than £300… or if you have a limit of £5000, keep your balance below £1500.

When it comes to missing a payment, you’ll lose 130 points regardless of the size of the debt. So missing a minimum credit card payment of £5 will affect your credit score just as much as a loan repayment that’s worth hundreds. Therefore, it’s never a good idea to miss any kind of bill payment if you can help it! If you’re struggling to make your repayments, contact your lender as they may be able to offer you a bit of financial relief.

All financial mistakes, including the ones listed above, will stay on your credit report for up to 6 years. But you’ll be pleased to know, Experian sees them as less of a problem as they get older. For example, a default will cost you around 350 points initially… however, when it’s two years old the impact reduces to 250 points and at four years old it drops again to 200 points.

What else does my credit report include?

Your credit report comprises a whole host of personal and financial information about you, such as:

- Your full name, address and date of birth

- If you’re registered to vote

- Current balances on credit cards and loans

- Details of any financial associations

- Any missed or late payments from the last 6 years

- Any CCJs made against you, defaults or IVAs

Don’t worry, your credit report doesn’t include things like:

- The balance in your current or savings account

- Student loan information

- Your salary

- Your medical or criminal history

- Parking or driving fines

- Council tax arrears

What is Experian’s credit score scale?

Experian’s credit score scale ranges from 0 to 999. A very poor credit score is between 0 and 560; a poor score is between 561 and 720; a fair score is between 721 and 880; a good score is between 881 and 960; and an excellent score is between 961 and 999.

Lenders use the information in your credit report, as well as the details you provide on your application, to assess whether you’re eligible for financial products like a credit card, loan or mortgage. Therefore, the higher your credit score, the more likely you are to be approved for financial products and secure lower interest rates which means borrowing is cheaper for you!

If your credit score could use a boost, be sure to follow the positive factors in the table above or read our guide on how to improve your credit score.

These figures are sourced from Debt Camel and This is Money, and are to be used as a guideline only. Experian’s points system can vary from person to person.

Disclaimer: We make every effort to ensure content is correct when published. Information on this website doesn't constitute financial advice, and we aren't responsible for the content of any external sites.